The bursting of the housing bubble has moved on tiptoe in the middle of the country. At least 8 of the 17 autonomous communities. He says the price index of Housing develops quarterly by the National Statistics Institute (INE), and it is revealed that in the whole country estate setting in new home in real terms (after inflation) is virtually nil: Only 3% in the whole country. In particularIf a house cost 100 units in 2007, three years later (annual average) its value at market prices stood at 97.224 units.

The most relevant case, However, is in Andalusia, Asturias, Canarias, Castilla y León, Castilla-La Mancha, Extremadura, Galicia and Murcia, where new housing not only has not decreased in the last three years since the bursting of the housing bubble, but on the contrary, has grown. In some cases quite significant, which is even more striking. In Extremadura, 11%, in Murcia, 6%, in Galicia and Andalusia above 4%, and in Asturias and the Canary Islands around 3%, again in real terms.

INE data emphasize an open divergence between new and used housing. To the extent that existing homes have passed the 100 level in 2007 to 84 last year, representing a decrease of 16% five times in the case of new housing. In general terms, ie taking into account both new and used housing (excluding official protection) the annual average decline was 10%. That is, has gone from 100 in 2007 at 90.071 to level three years later, which highlights moderation in price declines after a period of strong expansion.

The INE uses as a source of information for the rate of house price statistics all transactions performed in all the Spanish notary. They are, therefore, prices are reported at the time in which buyers and sellers raise the document acquisition and sale deed. It is not, therefore, a poll or a work based on the appraised value of the flats, but actual data, Which increases reliability. In fact, this methodology, both in regard to source of information and calculation procedures used, is harmonized with the European Union. It is, therefore, homogeneous.

And according to these data, prices have fallen more in Catalonia (-20% in three years) than any other site-weighted average of new and used homes. Here are Navarra (-18%), Aragon (-17%) and the Community of Madrid (-15%). On the contrary, have continued to rise in Extremadura, Galicia and Murcia, precisely because the pull of new housing, whose price has continued to grow deaf the macroeconomic situation.

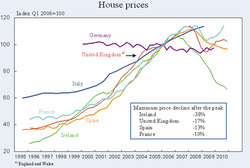

The attached chart, prepared by Professor Xavier Vives, Shows clearly how the adjustment in real estate in Spain has been more moderate than in other countries that have suffered bubble. While in Ireland and the UK the fall in prices since the peak has been 38% and 17%, respectively, in the Spanish case the decrease is limited (according to the Ministry of Housing and not the INE) by 13%. Vives participated in yesterday's presentation Report CESifo on the European Economy 2011, prepared by a team of seven economists from different European countries and sponsored by the BBVA Foundation.

Urban and nonurban

According to economist Julio Rodriguez, An expert on the housing market, Statistical data show the different behavior of urban and nonurban. While in the big cities the price adjustment is faster - "The market works best"- Exist in non-urban "Major assault" to bringing down the price of housing, but not sold the house for a long time.

Rodriguez, in any event highlights quality and sophistication INE survey, as it incorporates as hedonic regressions, ie compare the price of two houses or two goods of equal quality. For the index, also performed weights between existing homes and second hand, allowing make comparisons more homogeneous.

And the result in this case is striking. If at the beginning of the crisis for 46% of transactions were registered with new home notary in 2010 that percentage had grown to 54.7%. This means defying the economic laws of supply and demand, best selling houses (those showing the greatest number of transactions) are the least have fallen in price, while the lowest selling homes are those that paradoxically, have sufido biggest drop in prices.

This may be due to the INE transactions considered 'new' are actually recommendations made by developers for financial institutions to settle its debt. It is not, therefore, of new business in the strict sense, since the banks and the boxes are the houses and then sell to their customers. Julio Rodriguez, the housing market continues opacitiesIn particular in this aspect, it would have to differentiate what is a given (to cancel the loan) from a sale. And today the official statistics do not reflect this difference, which distorts the analysis of price trends.

The most relevant case, However, is in Andalusia, Asturias, Canarias, Castilla y León, Castilla-La Mancha, Extremadura, Galicia and Murcia, where new housing not only has not decreased in the last three years since the bursting of the housing bubble, but on the contrary, has grown. In some cases quite significant, which is even more striking. In Extremadura, 11%, in Murcia, 6%, in Galicia and Andalusia above 4%, and in Asturias and the Canary Islands around 3%, again in real terms.

INE data emphasize an open divergence between new and used housing. To the extent that existing homes have passed the 100 level in 2007 to 84 last year, representing a decrease of 16% five times in the case of new housing. In general terms, ie taking into account both new and used housing (excluding official protection) the annual average decline was 10%. That is, has gone from 100 in 2007 at 90.071 to level three years later, which highlights moderation in price declines after a period of strong expansion.

The INE uses as a source of information for the rate of house price statistics all transactions performed in all the Spanish notary. They are, therefore, prices are reported at the time in which buyers and sellers raise the document acquisition and sale deed. It is not, therefore, a poll or a work based on the appraised value of the flats, but actual data, Which increases reliability. In fact, this methodology, both in regard to source of information and calculation procedures used, is harmonized with the European Union. It is, therefore, homogeneous.

And according to these data, prices have fallen more in Catalonia (-20% in three years) than any other site-weighted average of new and used homes. Here are Navarra (-18%), Aragon (-17%) and the Community of Madrid (-15%). On the contrary, have continued to rise in Extremadura, Galicia and Murcia, precisely because the pull of new housing, whose price has continued to grow deaf the macroeconomic situation.

The attached chart, prepared by Professor Xavier Vives, Shows clearly how the adjustment in real estate in Spain has been more moderate than in other countries that have suffered bubble. While in Ireland and the UK the fall in prices since the peak has been 38% and 17%, respectively, in the Spanish case the decrease is limited (according to the Ministry of Housing and not the INE) by 13%. Vives participated in yesterday's presentation Report CESifo on the European Economy 2011, prepared by a team of seven economists from different European countries and sponsored by the BBVA Foundation.

Urban and nonurban

According to economist Julio Rodriguez, An expert on the housing market, Statistical data show the different behavior of urban and nonurban. While in the big cities the price adjustment is faster - "The market works best"- Exist in non-urban "Major assault" to bringing down the price of housing, but not sold the house for a long time.

Rodriguez, in any event highlights quality and sophistication INE survey, as it incorporates as hedonic regressions, ie compare the price of two houses or two goods of equal quality. For the index, also performed weights between existing homes and second hand, allowing make comparisons more homogeneous.

And the result in this case is striking. If at the beginning of the crisis for 46% of transactions were registered with new home notary in 2010 that percentage had grown to 54.7%. This means defying the economic laws of supply and demand, best selling houses (those showing the greatest number of transactions) are the least have fallen in price, while the lowest selling homes are those that paradoxically, have sufido biggest drop in prices.

This may be due to the INE transactions considered 'new' are actually recommendations made by developers for financial institutions to settle its debt. It is not, therefore, of new business in the strict sense, since the banks and the boxes are the houses and then sell to their customers. Julio Rodriguez, the housing market continues opacitiesIn particular in this aspect, it would have to differentiate what is a given (to cancel the loan) from a sale. And today the official statistics do not reflect this difference, which distorts the analysis of price trends.

RSS Feed

RSS Feed