This is your new blog post. Click here and start typing, or drag in elements from the top bar.

The final presentation by the Ministry of Economy to investors contains surprises. And not minor. According to page 29 this document delivered to investors by the Treasury last week, the stock of unsold homes will be located in 2013 at about 200,000 units. The figure may still seem high, but is about Least 300,000 homes expect the buyer at the moment. Three hundred thousand homes, according to Economy, will be absorbed by the market in such a short period of time.

This means that taking into account that each year will be completed between 150,000 and 200,000 additional housing, the housing market is facing a near future 'Frantic'. Or, at least 'Promising'. Of course, if the vice president's figures Salgado match reality. The economy should absorb a total of more than 700,000 new housing units (regardless of second-hand) in just three years. A truly important figure, and clearly impossible to meet in an economic context-sensitive and low capacity to generate jobs. The variable that ultimately determines the formation of new households.

Economic data, as illustrated in the diagram-are, however, something more than optimistic. The Government suggests to investors that the housing market has been adjusting very fast. To the extent that in 2010 the number of dwellings started and completed is almost similar, which allowed reduce the stock of unsold homes. Carca 200,000 in both cases.

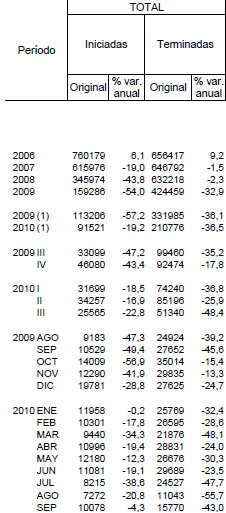

The reality, however, very different. The Figures from the Ministry of Public Works (P. 13) reflect, in particular, which began last year to September (latest figures closed) 91 521 flats. However, in the same period, 210,776 dwellings were completed both free and protected. That is, more than double.

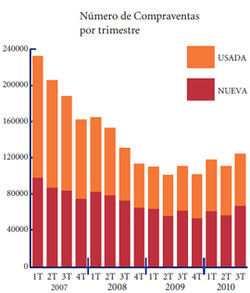

The land registry data indicate also that between the third quarter of 2010 and the same period last year the sale of homes was equivalent to 454,283 units, of which 53% are new. Therefore, around 240,000 dwellings were sold, a figure very similar to the finished (just 30,000 more). This means that at this rate it would take the Spanish economy 20 years to absorb the stock of unsold homes provided that the supply of new buildings is equivalent to demand. And we must bear in mind that in a year of particularly adverse to the residential construction sector as it was 2010, initiated more than 100,000 homes (91,421 to September).

The 210,776 houses completed in the first nine months of last year in contrast to the 655,417 that were completed in 2006, which marks the peak of the housing boom. Compared to 2009, this represents a step backwards no less than 57.2%.

This means that taking into account that each year will be completed between 150,000 and 200,000 additional housing, the housing market is facing a near future 'Frantic'. Or, at least 'Promising'. Of course, if the vice president's figures Salgado match reality. The economy should absorb a total of more than 700,000 new housing units (regardless of second-hand) in just three years. A truly important figure, and clearly impossible to meet in an economic context-sensitive and low capacity to generate jobs. The variable that ultimately determines the formation of new households.

Economic data, as illustrated in the diagram-are, however, something more than optimistic. The Government suggests to investors that the housing market has been adjusting very fast. To the extent that in 2010 the number of dwellings started and completed is almost similar, which allowed reduce the stock of unsold homes. Carca 200,000 in both cases.

The reality, however, very different. The Figures from the Ministry of Public Works (P. 13) reflect, in particular, which began last year to September (latest figures closed) 91 521 flats. However, in the same period, 210,776 dwellings were completed both free and protected. That is, more than double.

The land registry data indicate also that between the third quarter of 2010 and the same period last year the sale of homes was equivalent to 454,283 units, of which 53% are new. Therefore, around 240,000 dwellings were sold, a figure very similar to the finished (just 30,000 more). This means that at this rate it would take the Spanish economy 20 years to absorb the stock of unsold homes provided that the supply of new buildings is equivalent to demand. And we must bear in mind that in a year of particularly adverse to the residential construction sector as it was 2010, initiated more than 100,000 homes (91,421 to September).

The 210,776 houses completed in the first nine months of last year in contrast to the 655,417 that were completed in 2006, which marks the peak of the housing boom. Compared to 2009, this represents a step backwards no less than 57.2%.

In his presentation, however, economics suggests to investors that the housing adjustment is over. And for it is based on the weight of residential investment currently stands at 4.4% of GDP, a level similar to that recorded in 1995, at the end of the previous recession of the Spanish economy. The difference is, however, the stock of unsold homes, which at that time irrelevant and now stands at at least 600,000 homes. Many analysts have even this figure at about one million homes without a buyer.Only between 2007 and 2009, according to Public Works, the difference between the houses that were started and were completed, stood at 582,233 units. To this figure must be added those that came to market during that time and were built earlier. Hence, experts in the housing market are often revised upwards estimates of Economics.

RSS Feed

RSS Feed